Investment banking is a stream of banking that primarily focuses on capital financing for global and local businesses, individuals and even governments. These diversified finance requirements can be in the form of equity/debt IPO, bonds offering, mergers and acquisitions, portfolio management, etc.

How are investment banks ranked? While there can be several criteria, the easy ones to look at are the revenue numbers, global reach, employee headcount, income, etc.

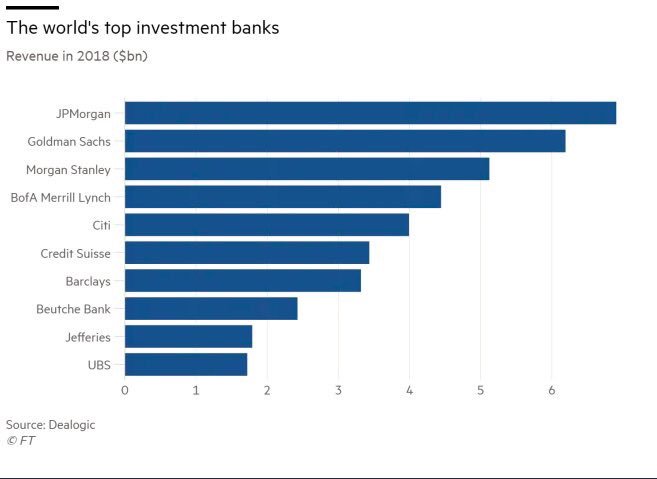

This article lists the Top 10 full-service global investment banks, with a brief introductory description and recent income details of each, based on a combination of the above-mentioned parameters. Although investment banks have a lot more functions (like retail banking) which may not necessarily fall within investment banking space, the list below indicates the top-rated banks and their numbers as a whole. Details specific to investment banking division are included, based on available data, as of Jan. 2020.

BUSINESS COMPANY PROFILES

The World's Top 10 Investment Banks

FACEBOOK

TWITTER

LINKEDIN

By SHOBHIT SETH Reviewed by MARGARET JAMES Updated Jan 23, 2021

Investment banking is a stream of banking that primarily focuses on capital financing for global and local businesses, individuals and even governments. These diversified finance requirements can be in the form of equity/debt IPO, bonds offering, mergers and acquisitions, portfolio management, etc.

How are investment banks ranked? While there can be several criteria, the easy ones to look at are the revenue numbers, global reach, employee headcount, income, etc.

This article lists the Top 10 full-service global investment banks, with a brief introductory description and recent income details of each, based on a combination of the above-mentioned parameters. Although investment banks have a lot more functions (like retail banking) which may not necessarily fall within investment banking space, the list below indicates the top-rated banks and their numbers as a whole. Details specific to investment banking division are included, based on available data, as of Jan. 2020.

The World’s Top 8 Investment Banks

· Goldman Sachs (GS): One of the oldest banking firms founded in 1869 and headquartered in New York City, GS offers a wide range of services spread across four divisions—investment banking, institutional client services, investing and lending and investment management. Goldman Sachs reported net revenues of $36.62 billion for fiscal year 2018, of which investment banking division contributed $7.86 billion. The revenue generated in the investment banking division was the highest among all divisions. Earnings per share were $25.27.1

· JP Morgan Chase (JPM): One of the largest investment banks, JPM Chase reported net revenues of $109 billion for FY 2018, of which investment banking revenue contributed $36.4 billion. EPS was $9. The firm has $2.62 trillion in assets and $256 billion in stockholders' equity and operates in 60 countries with more than 256,000 employees with a diversified set of services.2 Apart from investment banking, it also operates in consumer and community banking, commercial banking, asset and wealth management, and corporate.

· Barclays (BCS): Founded in 1896, London, U.K. based investment bank hit the headlines for allegations about the rigging of London interbank rates and news about a huge number of job cuts globally in 2013. Backed by a strong workforce of 86,800 employees globally, the 2018 annual report indicates a total income of £21.1 billion of which the investment banking segment contributed to £9.8 billion. Overall, EPS was £9.2.3 Along with investment banking, it has a strong presence in retail and commercial banking and card processing business.

· Bank of America Corporation (BAC): Bank of America Corporation is an American multinational banking and financial services company that offers a wide array of banking services including investment banking, mortgage, trading, brokerage, and card services. Operating in 40 countries across the globe with a total net income of $28.1 billion in FY 2018, the investment banking division contributed $8.1 billion. The overall EPS was $2.61.4

· Morgan Stanley (MS): Founded in 1935 and headquartered in New York USA, the global firm employs 60,348 employees spread across multiple countries. It reported a net revenue of $40.1 billion in FY 2018, of which the investment banking segment contributed $6.1 billion, increasing from $5.5 billion a year ago. EPS was $4.73.5 Apart from the usual capital raising, M&A, corporate restructuring services, the firm also offers diversified services like prime brokerage, custodian, settlement and clearing, etc.

· Deutsche Bank (DB): Based in Germany and listed on the New York stock exchange, Deutsche Bank reported net revenue of EUR 25.316 billion, down by 4.3% year-on-year.6 One of the largest financial services firms of Europe, DB specializes in cross border payments, international trade financing, cash management, card services, mortgage, insurance, and the usual investment banking stream. Deutsche has a global presence with operations in 71 countries.

· Citigroup (C): Tracing its roots back to the origin of Citibank in 1812, Citi has 204,000 employees with business and operations in 160 countries. Of the total revenues of $72.9 billion reported for 2018, contributions from investment banking fell 7% from the prior year to $5.01 billion. EPS was $6.68.7 The bank has a strong presence in investment banking, investment management, private banking, and card processing streams.

· Credit Suisse (DHY): With a net income of CHF 20.92 billion and EPS of 0.77 in 2018, the Zurich Switzerland based Credit Suisse group founded in 1856 today employs 45,680 workers across the globe in over 50 countries.8 Apart from the regular investment banking business, it also has presence in taxation and advisory, structural lending, real estate leasing and investment research services.

· UBS Group AG (UBS): Another Swiss investment firm founded in 1862 and headquartered in Zurich, UBS had a net profit of $4.52 billion and EPS of $1.18 in the year 2018.9 The firm has a strong workforce of around 60,000 employees across the globe with the majority of them in the U.S. and Switzerland. The firm specializes in services to high net worth and ultra-high net worth individuals, in addition to the investment banking, private, retail and commercial banking streams.

· HSBC Holdings plc (HSBC): Another London based financial powerhouse founded in 1865 with operation in 75 countries serving 39 million global customers through 235,000 employees, HSBC offers a wide variety of services ranging from forex, leasing, M&A, card processing, account services, investment banking, and private banking. Revenue totaling $ 53.8 billion for 2018—up 2.3% from the year before. EPS was $0.63